Over the medium-term, however, Europeans have signaled a new-found determination to lessen their dependence on Russian energy. This is difficult but doable. Much will depend on progress at home, via greater energy efficiencies, ramp-up of strategic reserves, rapid deployment of renewables and clean technologies, and better energy infrastructure connections. The nature and pace of this shift will also depend on Europe’s energy and innovation ties to other countries beyond Russia – notably, the United States.

U.S. and European firms are deeply embedded in each other’s traditional and renewable energy markets – through trade, foreign investment, cross-border financing, and collaboration in research and development (R&D).

Little-noticed amid the focus on Russian-European energy links is the fact that in 2021, the United States became Europe’s largest supplier of liquefied natural gas (LNG), accounting for 26% of all LNG imported by EU member countries and the UK. Qatar supplied 24% of Europe’s needs, and Russia accounted for an additional 20%. In January and February 2022, the United States supplied more than half of all LNG imports into Europe, shipping more to Europe than ever before. Europe accounted for about 75% of all U.S. LNG exports, far outpacing exports to Asia. U.S. tankers on their way to Asia literally turned around to head for Europe. Moreover, for the first time ever, U.S. exports of liquefied natural gas to Europe exceeded Russia’s overall natural gas pipeline deliveries.

While the United States will not fully replace other suppliers for energy-starved Europe, transatlantic energy connections are growing in importance, as the United States becomes the world’s largest LNG supplier, and as U.S. and European companies lead the transition to competitive clean technologies.

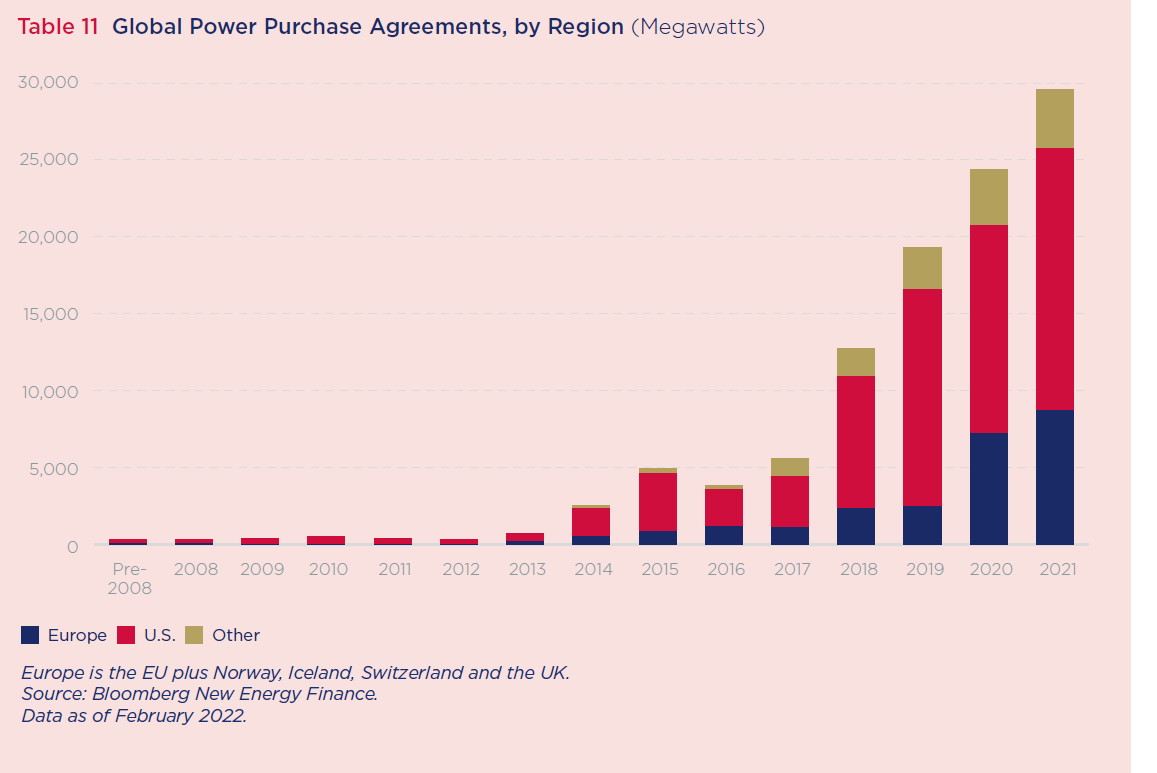

Largely unnoticed by media and politicians, U.S. companies in Europe have also become a driving force for Europe’s green revolution, especially through the addition of wind and solar capacity on the continent. Since 2007, U.S. companies have been responsible for more than half of the long-term renewable energy purchase agreements in Europe. U.S. companies account for three of the top four purchasers of solar and wind capacity and five of the top ten purchasers of renewable energies in Europe. Purchase agreements for wind, solar, and other renewable power sources in Europe surged in 2020 and 2021, reaching nearly 9,000 megawatts last year – or more than triple the amount from 2019. The United States and Europe are the top destinations for power investments – making up almost 90% of total global power purchase agreements in 2021.

Supporting the discovery of future green technologies, government budgets for energy research, development, and demonstration in North America and Europe totaled $19.1 billion in 2020, according to the International Energy Agency. This was more than double the amount spent in China. Business funded R&D has also become increasingly important in the United States and Europe. A dynamic and innovative private sector should continue to drive investments and innovations in renewable energy R&D over the coming decade.

If you want to know more about the transatlantic energy economy, download our Transatlantic Economy Report.